ABN AMRO - Overdraft

At ABN AMRO I was the UX Designer of Consumer Credits within the Daily Banking team for two years, during this time I was responsible for all research, design and optimisation work of application flows, product overview pages and change processes within the domain of Consumer Credits.

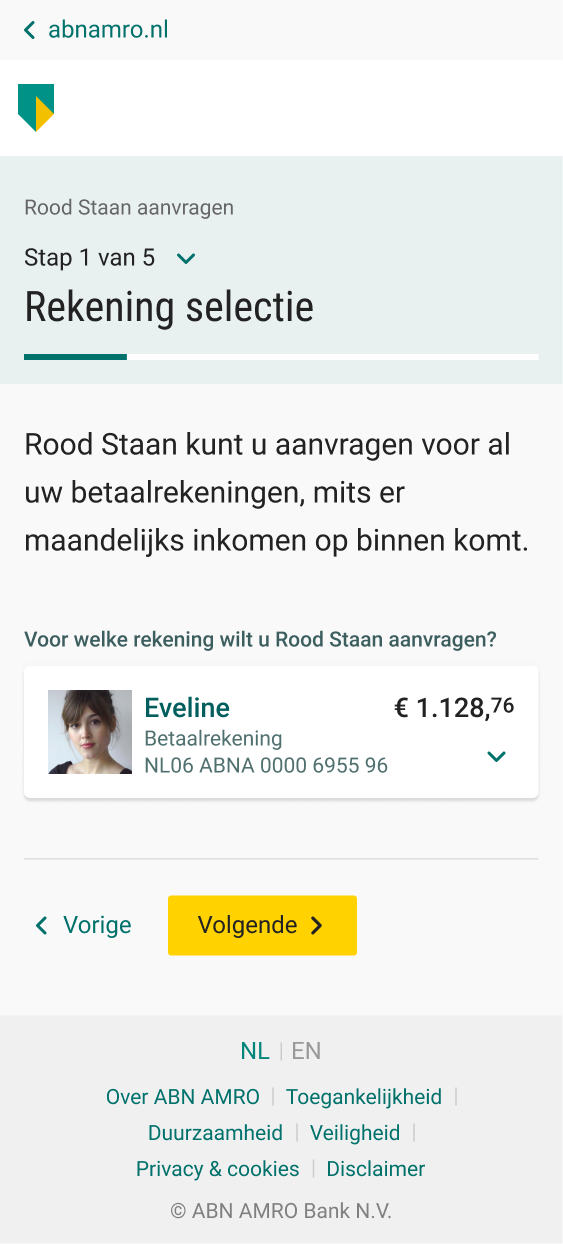

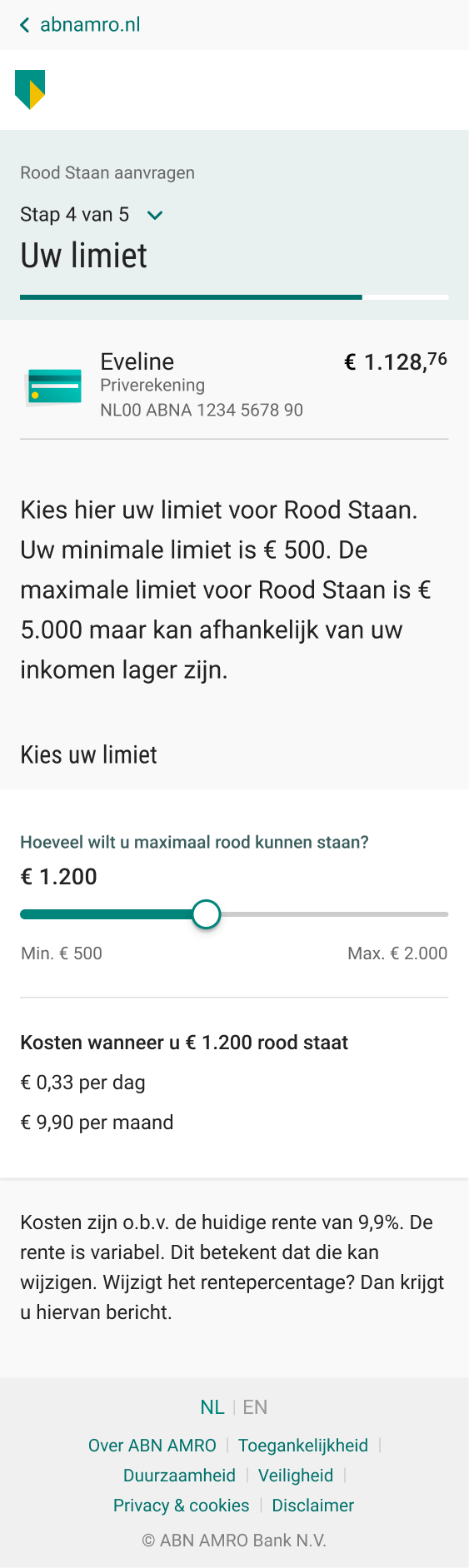

Multiple Overdraft (Rood Staan) products needed to be merged into one product as well as new loan standards (nieuwe leennormen consumptief krediet) from the AFM needed to be implemented. This caused that a simple application flow to become extensive and more complex for the user. The challenge was to come up with a solution that was simple and straight-forward.

My Role

As the UX designer I primarily worked on Interaction and UI design, and on the user testing and interviews.

Goal

Overdraft used to be a simple on/off switch with a desired limit. With the new loan standards this changes, but with use of new technologies it's possible to make it simple again.

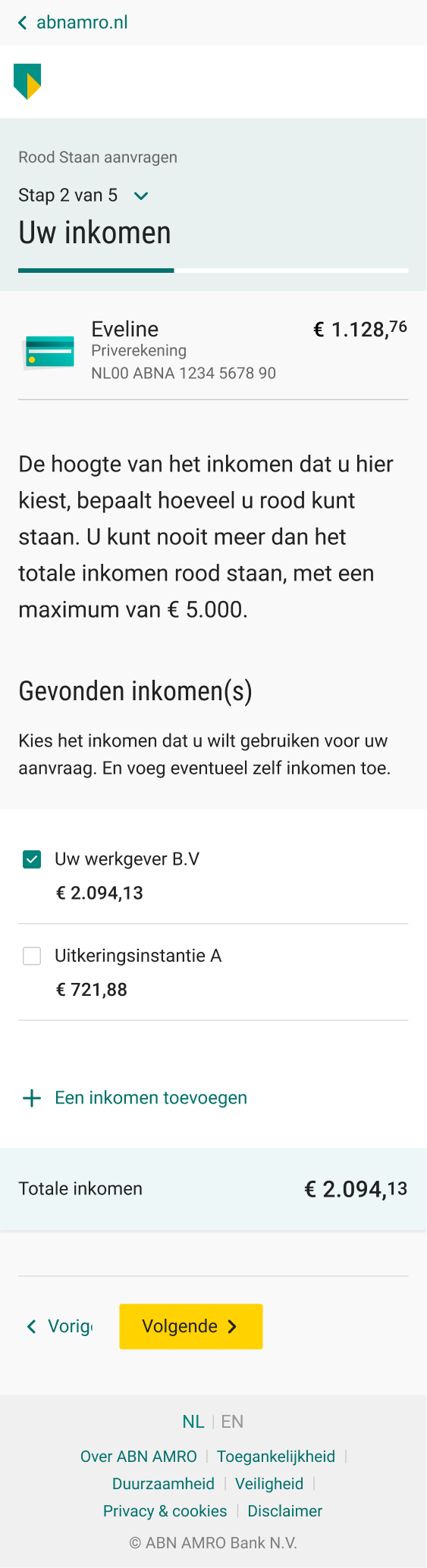

- To apply for overdraft with a desired limit that is financially safe and responsible.

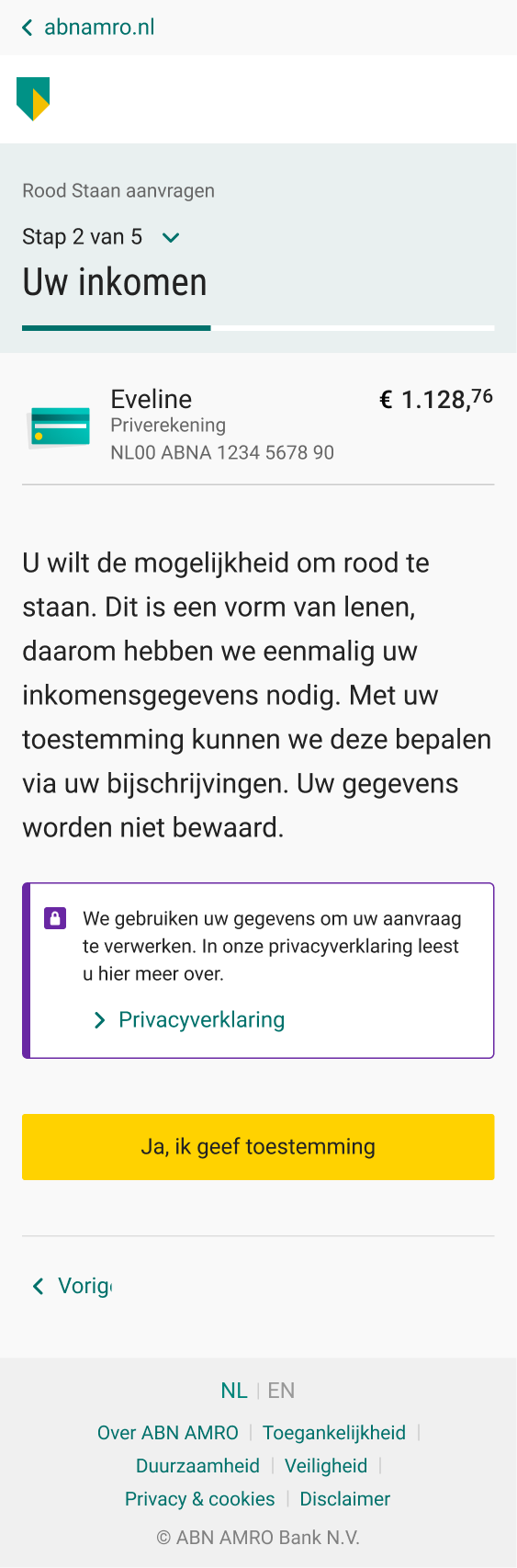

- To make the user aware of the fact that overdraft is a type of loan.

- To create an application flow that is as simple as an on/off switch.

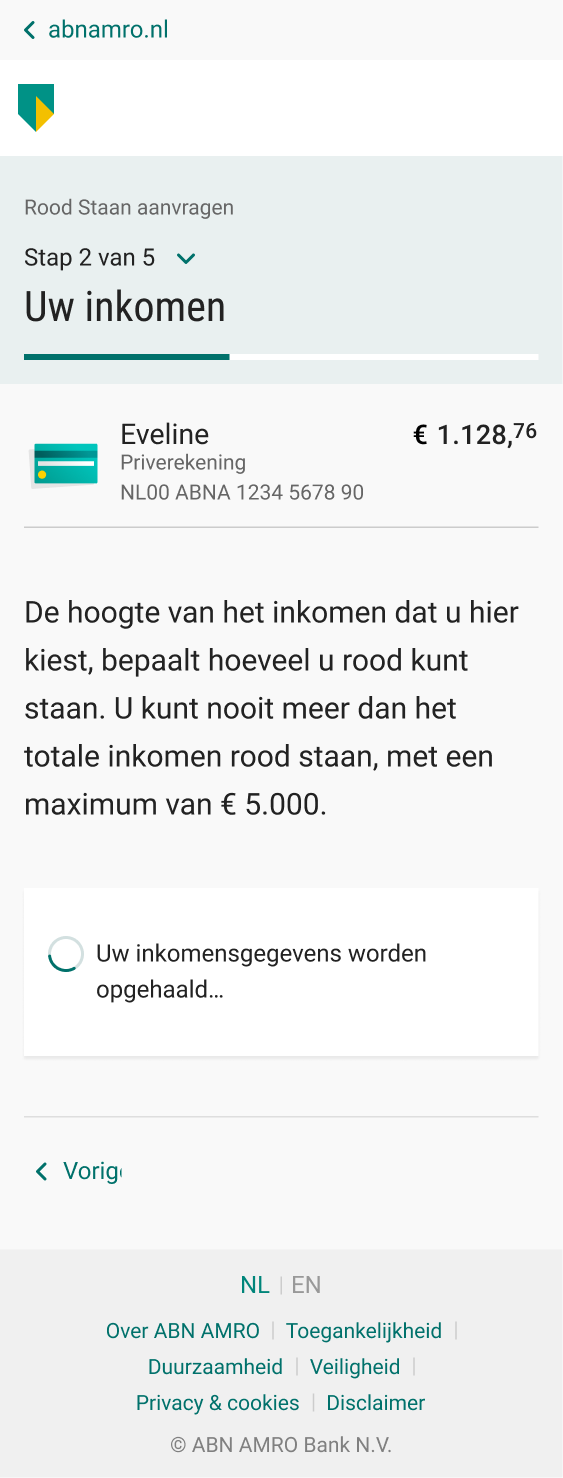

- To make use of innovative technologies, in order to save the user's time on submitting income details

Design process

User interviews: Discover users’ needs and thoughts about applying for overdraft.

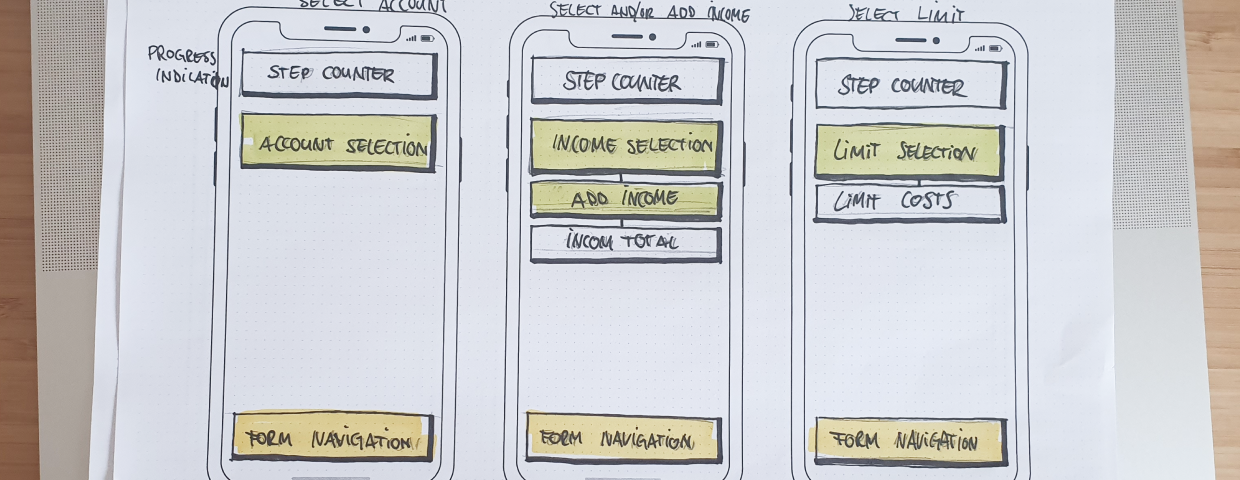

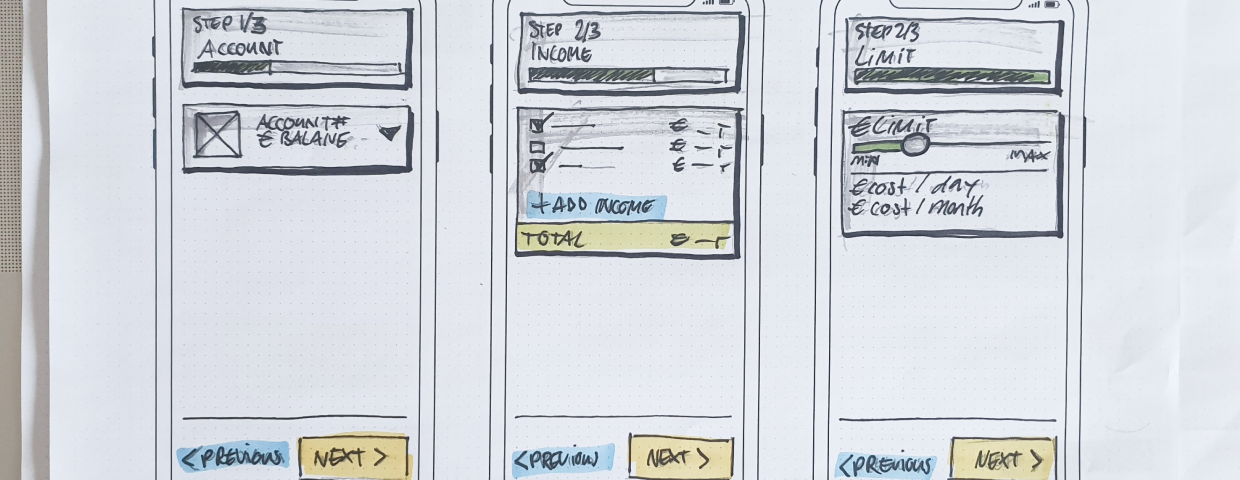

Wireframing: Create page schematics with the purpose of content prioritization, defining available functionalities, and intended behaviors.

Ideation & Validation: test prototypes with users in UX lab, improve and come back.

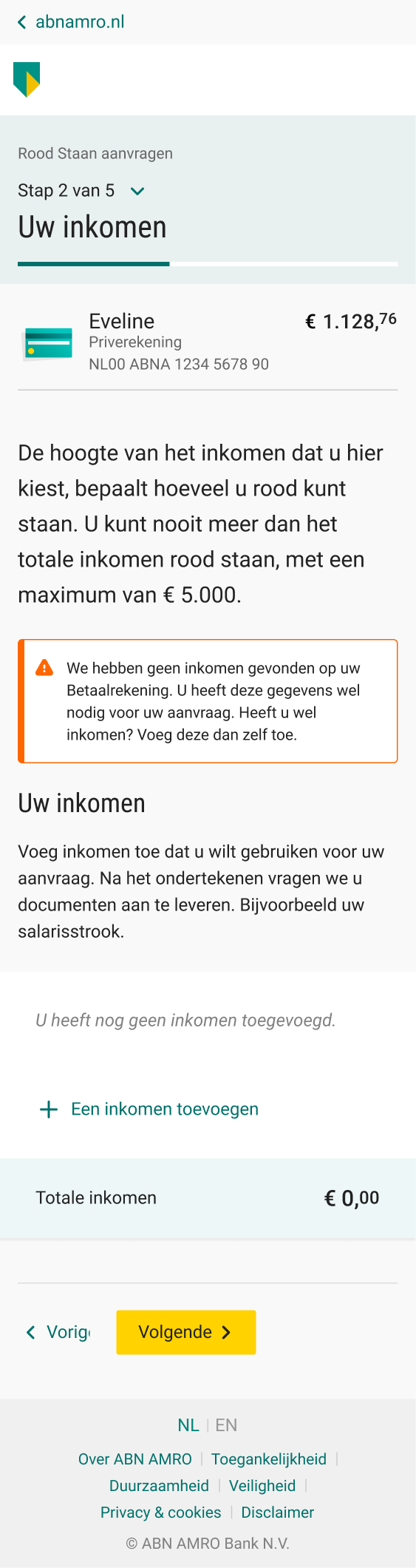

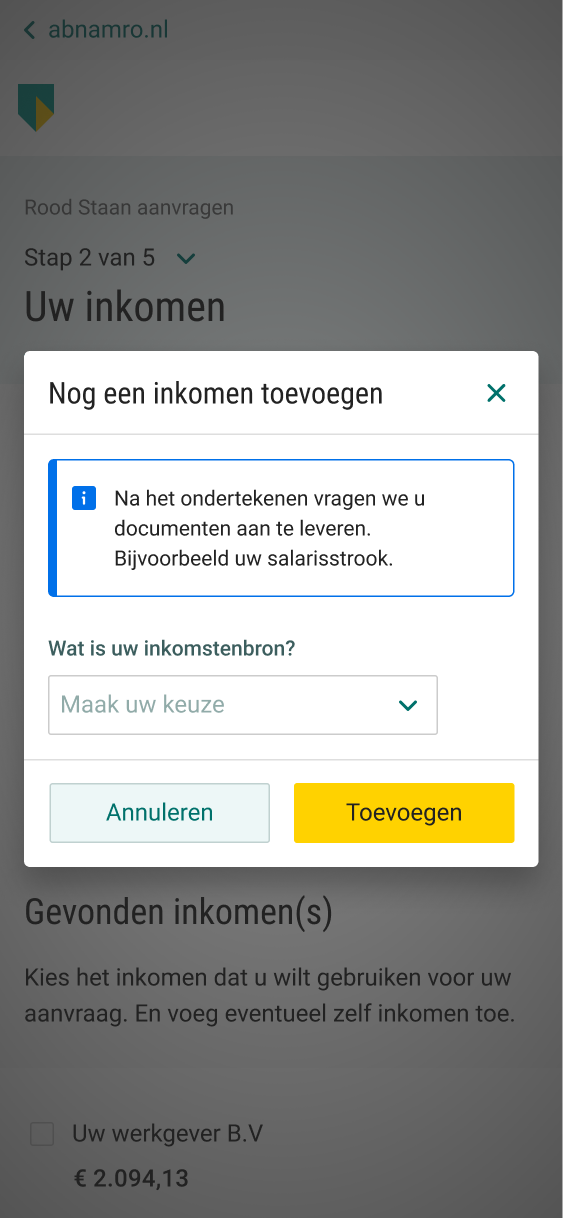

UI Design: create responsive and detailed designs for the development team.

Topic research

How users see overdraft and if they are aware of overdraft being a type of loan.

Scope

User: People with an MBO/HBO degree, aging 20–55 years old, making use of the ABN AMRO banking app or online banking.

Market: ABN AMRO customers.

Findings

Users are not aware that overdraft is a type of loan and a negative balance is registered with the BKR.

Users think requesting overdraft on their bank account is nothing but an on/off switch.

Most users would apply for overdraft through their mobile phone.

Giving details about their income is not an issue. Users think the bank already "knows everything" about them.

Warning about the costs of overdraft (interest) is a necessity to the users' needs.

Design principles

Simple: The application flow should be simple to use. The users do not need to learn a new pattern.

Innovative: The design should take a new and exciting approach that anticipates and satisfies user needs.

Transparent: The provided information about costs (interest) should be straight-forward to warn the user.

Results

Users are now able to apply for Overdraft on their checking accounts.

- Application flow feels like a simple on-off switch, with minimum manual user input.

- Income details are automated as they are gathered from the bank account (upon user approval).

- Maximum available and chosen limit is financially safe and responsible, so it meets the requirements of the AFM.